UK House Prices Drop as Rent Increases Slow to 4-Year Low, Surveys Reveal

October 10th 2025

In a housing market long plagued by affordability woes and post-pandemic volatility, the latest surveys paint a picture of cautious stabilization in the UK. House prices edged lower in September, signaling a potential softening in buyer demand amid economic uncertainties, while rental growth has decelerated to its slowest pace in four years. This dual dynamic—declining sales prices juxtaposed with moderating rents—offers a glimmer of relief for aspiring homeowners and tenants alike, though experts caution that broader challenges like interest rates and budget anticipation persist.

Drawing from authoritative sources including the Office for National Statistics (ONS), Halifax, Nationwide, and Zoopla, this analysis delves into the data, regional disparities, and underlying drivers shaping the UK’s residential property landscape as we head into the final quarter of 2025.

House Prices: A Modest September Decline Amid Weaker Annual Growth

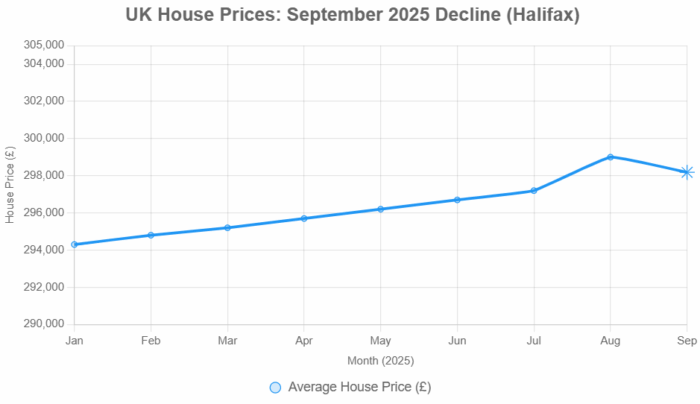

Halifax House Price Index for September 2025

The UK’s house price trajectory took a subtle downturn in September, with the average property value dipping by 0.3% month-on-month, erasing prior gains and bringing the typical home price to approximately £288,206—a decrease of £794 from August levels. This marks the third consecutive month of faltering momentum in the sales market, as reported by Halifax’s influential House Price Index.

On an annual basis, growth has similarly cooled. Halifax data indicates a year-on-year increase of just 1.3% for the 12 months to September 2025, the weakest reading since April 2024 and a notable slowdown from the 2.0% recorded the previous month. In contrast, Nationwide’s index offers a slightly more optimistic view, pegging annual growth at 2.2% for September, with a 0.5% monthly rise. These discrepancies highlight the variability across indices, but the consensus is clear: the post-2024 recovery is losing steam.

Official ONS figures, which provide a more comprehensive view based on completed sales, show average house prices reaching £270,000 in the 12 months to July 2025—a 2.8% annual uplift, though this rate has decelerated from earlier peaks. The UK House Price Index from HM Land Registry corroborates this, noting an average of £269,735 as of July, with a modest 0.3% monthly increase but ongoing regional fragmentation.

Regional Breakdown: North-South Divide Persists

The slowdown isn’t uniform across the country. Northern regions continue to outperform, buoyed by relatively lower entry prices and stronger wage growth. For instance:

- North West: Annual growth of 3.5%, with average prices around £220,000, driven by robust demand in Manchester and Liverpool.

- Scotland: Up 2.9% year-on-year, with Edinburgh seeing particular resilience at £320,000 averages.

- South East and London: Lagging with just 0.8% and 0.5% growth, respectively, as high costs and commuter belt uncertainties weigh on buyers.

This north-south chasm underscores a market where affordability gaps exacerbate inequality, with southern buyers facing borrowing costs that consume over 40% of take-home pay in many cases.

Rental Market: Easing Pressures, But Affordability Remains Elusive

While homeownership edges toward accessibility, the rental sector—home to nearly 5 million UK households—shows signs of relief after years of double-digit surges. Zoopla’s Rental Market Report for September 2025 reveals average new-let rents at £1,301, a mere 2.4% higher than the previous year—the slowest annual increase since 2021 and a sharp pullback from the 8-10% peaks of 2023-2024. This deceleration aligns with broader surveys, including Reuters’ aggregation of industry data, which confirms rents rose by the least in four years during the four weeks to September 2.

However, ONS data tempers this optimism. Provisional estimates indicate average private rents climbed 5.7% year-on-year to £1,348 in the 12 months to August 2025, with England leading at 5.8% (£1,403 average), Wales at 7.8% (£811), and Scotland at 3.5% (£1,002). The discrepancy arises from methodological differences: Zoopla focuses on new tenancies, which better capture market softening, while ONS includes all ongoing contracts.

Recent October updates suggest further cooling. Canopy’s quarterly analysis reports year-on-year rent falls in the North West (£707 average, down £20), while national supply has surged 15% in the flatshare segment since Q2, easing competition. Room rents, a key metric for young professionals, hit a record £728 nationally but with growth stalling at under 3%.

| Metric | Value (Sep/Oct 2025) | YoY Change | Source |

|---|---|---|---|

| Average New-Let Rent | £1,301 | +2.4% | Zoopla |

| All Private Rents | £1,348 | +5.7% | ONS (to Aug) |

| England Average | £1,403 | +5.8% | ONS |

| North West Average | £707 | -2.8% | Canopy |

| Room Rent National | £728 | +2.9% | Landlord Today |

This table illustrates the nuanced slowdown: headline figures mask pockets of relief, particularly in supply-rich areas.

Key Drivers: From Interest Rates to Budget Jitters

Several macroeconomic factors are at play. The Bank of England’s base rate, steady at 5% since August, continues to deter leveraged buyers, with mortgage approvals down 5% month-on-month per RICS surveys. Anticipation of the Autumn Budget on October 30 has injected caution, as potential stamp duty hikes or capital gains tax reforms loom, per Forbes analysis.

On the rental side, a 12% year-on-year increase in available properties—fueled by landlord sales amid higher taxation—has tempered landlord pricing power. Wage growth, at 4.1% in Q2, outpaces rent inflation for the first time in years, offering tenants marginal breathing room, though CPIH inflation ticked up to 4.1% in August.

Industry voices echo restraint. Daniel Austin, Zoopla’s Head of Research, notes: “The rental market is transitioning from boom to balance, with increased supply finally curbing excessive growth.” Meanwhile, RICS’ September survey signals “downward pressure” on prices, with a -15% net balance for national values.

Outlook: Stabilisation or Stagnation?

As 2025 draws to a close, the UK’s housing market teeters on the brink of equilibrium. A potential rate cut in November could reignite buyer activity, lifting prices by 1-2% into 2026, according to Hometrack forecasts. Rents, meanwhile, may hover at 3-4% growth if supply trends hold, per Lendlord’s Q3 projections.

For buyers and renters, this moment demands vigilance: monitor budget outcomes and lock in rates where possible. Policymakers, too, face a pivotal test—balancing stimulus with sustainability to prevent a deeper chill.

This evolving landscape underscores the resilience of the UK property sector, even as it navigates headwinds. For the latest updates, consult primary sources like the ONS and major indices.